In today’s era, technology and inventions have overpowered every single thing which was traditionally hard-fought and earned. With this increase in innovation, there are certain things and effects which have popped up. Diseases have increased and the need for regular medical aid and assistance has also shot up. People in their old age have started realizing the right need for their medical needs.

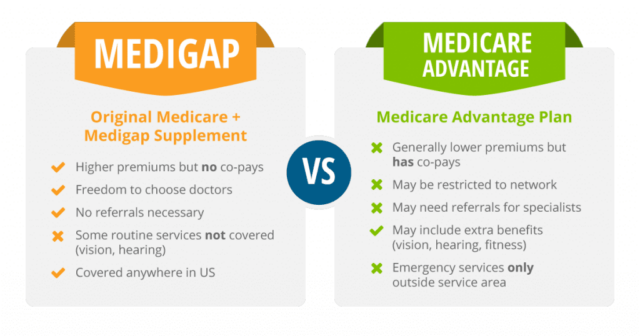

This increasing need for medical care has led to people buying medical insurance and medicare supplement plans for a better future. The popularity of plans like medicare supplement plans in virginia, or any other city/country has resulted in an upsurge in these plans. However, people should undertake the medical insurance policies which are best for them. Often, they get confused between medicare supplement plans and medicare advantage. Eventually, they end up buying the one which does not have enough benefits for them. Therefore, it is crucial to understand these policies in depth.

The following section differentiates these two interrelated terms and suggests the right one for the people. In order to understand both these concepts clearly, it is better to get into the details of both separately.

Medicare Advantage

Many experts term medicare advantage as Part C of the medical insurance policies. Generally, a person will find this plan offered by private insurers rather than government entities. The greatest highlight of medicare advantage is that it covers almost all the costs or benefits. Furthermore, in most cases, it also provides extra perks such as dental care, hearing aid, vision, prescription drugs, fitness coverage, etc.

However, these private insurance companies will utilize users’ data in their own way and will not provide the user with their choice of doctor and hospital. Coming to the eligibility criteria for enrolling in this plan, the following points highlight certain conditions to be fulfilled.

- The user should be at least 65 years of age.

- Any person below 65 years of age with a disability can also undertake these plans.

- Apart from this, people with the final stage of renal disease are also eligible for this type of plan.

- One of the most vital conditions is that the person should also have enrolled in Part A and Part B of medicare.

Most Effective Benefits Of Medicare Advantage

Medicare advantage has numerous merits, which are evident in the form of people enrolling in the same. The package acts as an all-in-one bundle of benefits as it not only covers the costs included in the original medicare, but also has coverage for extra items and services such as vision and hearing.

Moreover, these plans act as hotels working on their products to cater to consumer needs. Private insurers add extra features like doctor visits, pest controls, non-medical transportation, meals, adult day care services, and many additional benefits in the medicare advantage plan to serve the users better.

Medicare Supplement Plans

Similar to medicare advantage, these are also availed by private insurers who help the users get the extra benefits that are not provided in the original medicare plan. In short, it can be termed as a small subpart of medicare advantage. These extra expenses majorly include copays, coinsurance, and deductibles, among several others.

In medicare supplement plans, a person can use a suitable plan from different sub-plans. These range from alphabet A to N (10 plans). These plans have different coverage and costs according to the user’s convenience. Different add-ons depend on the usage and the person. Most of the eligibility conditions that are required in a medicare advantage plan are also included in a medicare supplement plan, such as 65 years of age, etc.

Top Merits Of Medicare Supplement Plans

Medicare supplement plans are an excellent way to cut out on additional costs which might pile up at the end of the medical care. The out-of-pocket expenses which might create a stressful situation in the user’s mind might get invalidated through such plans.

It is moreover a cost-effective option rather than a complete policy. It eases the budget and also creates a hassle-free decision of which doctor and hospital to choose. Unlike Medicare advantage, supplement plans allow the user to get treated by any doctor in the town.

Top Notable Differences Between Medicare Advantage and Medicare Supplement Plan You Should Know

There are numerous differences between the two policies and terms. The most basic one is the difference in their coverage. Medical insurance policies or medicare have two different components, namely Part A and B. These two divisions cover different expenses that are covered in the policy. So, in a medicare advantage setup, it covers both these parts where expenses are provided by the insurance company.

On the other hand, Medigap (also termed a medicare supplement) is an add-on to the existing medicare advantage policy. In other words, it covers the out-of-pocket expenses, coinsurance, deductibles, etc., which are not included in any parts of medicare advantage.

In medicare advantage, most benefits and expenses are covered altogether. But in Medigap, these expenses and benefits are provided in different segments and parts of the policy. It depends on the insurance company how they offer these services and at what cost. Another difference that makes these two different from each other is the choice of doctors a user can select.

Which One To Buy Between The Two?

The end decision to buy one of these two options lies in the hands of the end user. The need, age of the person, and severity of the medical care required are key factors to determine the right policy.

However, a lot of research goes into the entire process of selecting the best policy for a person. It might be the cost aspect or the medical assistance required. Furthermore, the ability to bear the additional costs also holds a decent composition in the selection process.